20060630 A pause after the big rally on Thursday. Plan to look to long retracement into fib levels.

20060630 A pause after the big rally on Thursday. Plan to look to long retracement into fib levels.  E-mini S&P 500 chart

E-mini S&P 500 chart

Chronicle of trading in ES S&P 500 index futures using momentum indicator CCI. Charts by www.futuresource.com. Note: The content here are for educational purposes only. Nothing in this blog constitute advice to buy or sell financial instruments and should not be construed as 'investment advice'.

20060630 A pause after the big rally on Thursday. Plan to look to long retracement into fib levels.

20060630 A pause after the big rally on Thursday. Plan to look to long retracement into fib levels.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060629 ES breaks out of consolidation, could be in trending phase. Looking to buy pullbacks to the moving average.

20060629 ES breaks out of consolidation, could be in trending phase. Looking to buy pullbacks to the moving average.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060628 ES failed to follow through to the downside. Waiting for the FOMC decision to decide next move.

20060628 ES failed to follow through to the downside. Waiting for the FOMC decision to decide next move.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060627 Ahead of the 2 day FOMC meeting 28/6, ES breaks out of 1242 level, out of the double ID pattern. Expecting some follow through to the downside.

20060627 Ahead of the 2 day FOMC meeting 28/6, ES breaks out of 1242 level, out of the double ID pattern. Expecting some follow through to the downside.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060626 ES is congesting, forming tight coiled spring. Should be breakout coming.

20060626 ES is congesting, forming tight coiled spring. Should be breakout coming.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060623 ES showing 2 Inside Day patterns. Breakout of 1265 or breakdown of 1248 signals long and short respectively.

20060623 ES showing 2 Inside Day patterns. Breakout of 1265 or breakdown of 1248 signals long and short respectively.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060621 A 'morning star' continuation candlestick buy signal, with CCI momentum confirmation.

20060621 A 'morning star' continuation candlestick buy signal, with CCI momentum confirmation.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060620 Forms a 'spinning top' inside day. May look for breakout of this range.

20060620 Forms a 'spinning top' inside day. May look for breakout of this range.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060619 Engulfing bearish formation, with CCI ZLR sell signal. Breaking 1244 moving avg will see retest of the lows.

20060619 Engulfing bearish formation, with CCI ZLR sell signal. Breaking 1244 moving avg will see retest of the lows.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060615 The CCI divergence, capitulation conditions borne out in the strong rally today. Resistance at the 34 ema.

20060615 The CCI divergence, capitulation conditions borne out in the strong rally today. Resistance at the 34 ema.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060614 The expected capitulation rally eventuated off support at 1220. Needs a close above 1230 today to indicate ocntinuation.

20060614 The expected capitulation rally eventuated off support at 1220. Needs a close above 1230 today to indicate ocntinuation.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060613 Capitulation on the cards.

20060613 Capitulation on the cards. E-mini S&P 500 chart

E-mini S&P 500 chart

20060612 Closes below the key 1247 level. ES needs to get back above 1245 to be out of immediate danger.

20060612 Closes below the key 1247 level. ES needs to get back above 1245 to be out of immediate danger.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060609 ES price action fails to confirm the hammer reversal, being unable to sustain gains. But as long as 1247 and then 1235 holds, we have a chance to bounce higher.

20060609 ES price action fails to confirm the hammer reversal, being unable to sustain gains. But as long as 1247 and then 1235 holds, we have a chance to bounce higher.  E-mini S&P 500 chart

E-mini S&P 500 chart

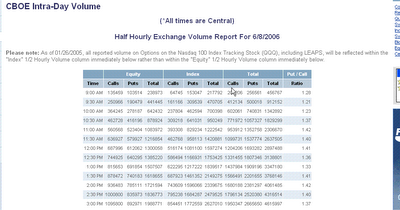

20060608 The ES morning sell off was an example of capitulation setup. 3 consecutive -1000 readings on the NYSE TICK could have given heads up on irrational selling. We long the ES June 1250 calls at 9.50 to take advantage of a potential rebound. In addition, the combined CBOE put call ratio spent the entir e day above 1.0, which is a contrarian indicator not to position trade short today

20060608 The ES morning sell off was an example of capitulation setup. 3 consecutive -1000 readings on the NYSE TICK could have given heads up on irrational selling. We long the ES June 1250 calls at 9.50 to take advantage of a potential rebound. In addition, the combined CBOE put call ratio spent the entir e day above 1.0, which is a contrarian indicator not to position trade short today  E-mini S&P 500 chart

E-mini S&P 500 chart

20060608 ES shows a bullish reversal hammer pattern which is expected to see rebound continue for 2 to 3 days.

20060608 ES shows a bullish reversal hammer pattern which is expected to see rebound continue for 2 to 3 days.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060606 Tests support and makes new low. Looking for close above 1274 to go long for potential reversal trade.

20060606 Tests support and makes new low. Looking for close above 1274 to go long for potential reversal trade.  E-mini S&P 500 chart

E-mini S&P 500 chart

20060602 Continuation of the rebound, off the morning star reversal candlestick formation.

20060602 Continuation of the rebound, off the morning star reversal candlestick formation.  E-mini S&P 500 chart

E-mini S&P 500 chart